Paying high electricity bills can be a challenge for commercial businesses, especially during times of high usage. To make things easier, MEPCO (Multan Electric Power Company) offers a bill installment plan for commercial consumers. This allows businesses to break down their electricity bill into smaller, manageable payments. In this article, we will explain how the installment plan works, who can apply it, and the benefits of this service.

| Key Points | Details |

| Installment plan available for businesses | Helps ease the financial burden |

| Eligibility based on past payment history | Requires submission of application to MEPCO |

| Spreads bill payments over several months | Can avoid electricity disconnection |

Contents

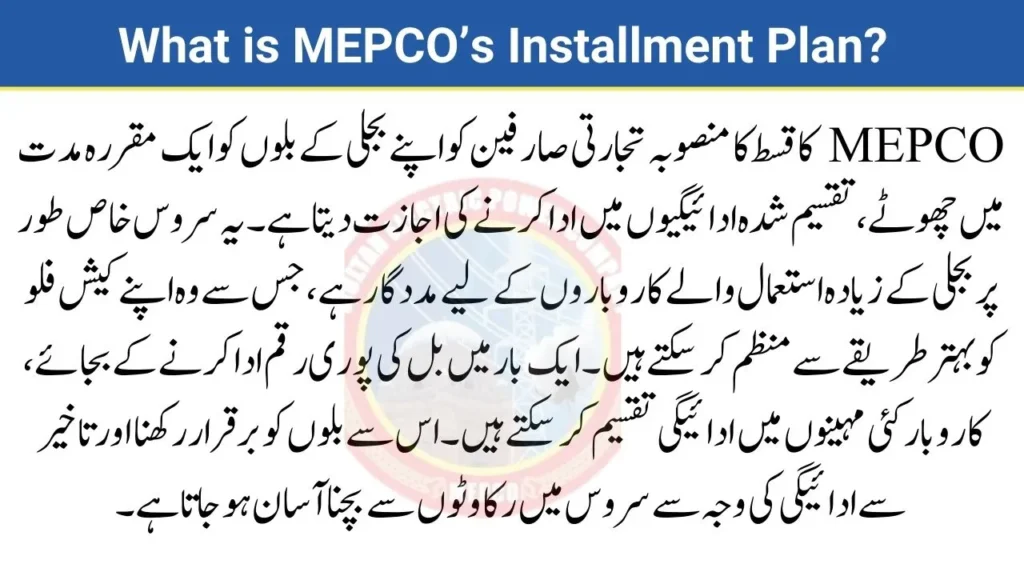

What is MEPCO’s Installment Plan?

MEPCO’s installment plan allows commercial consumers to pay their electricity bills in smaller, divided payments over a set period. This service is especially helpful for businesses with high electricity usage, enabling them to manage their cash flow better. Instead of paying the full bill amount in one go, businesses can distribute the payment over several months. This makes it easier to keep up with bills and avoid service disruptions due to late payments.

Eligibility for the Installment Plan

Not every commercial consumer is eligible for the installment plan. MEPCO reviews each request based on factors like payment history and the total bill amount. Businesses that have been consistently paying their bills and face unexpectedly high charges may have a better chance of approval. It’s important to have a clean record with MEPCO to increase your chances of qualifying for the installment plan.

How to Apply for the Installment Plan

To apply for the MEPCO installment plan, commercial consumers must visit their nearest MEPCO office and submit an application. The application should include the latest bill, proof of business registration, and other supporting documents. MEPCO’s team will review the request and decide if the consumer qualifies for the installment plan. After approval, the consumer can start paying the bill in smaller portions over the agreed time frame.

- Visit your nearest MEPCO office

- Submit an application with the necessary documents

- Attach copies of recent bills

- Wait for MEPCO’s approval

Benefits of the Installment Plan

The installment plan offers many benefits for commercial consumers. Firstly, it helps businesses manage their finances by spreading out the cost of their electricity bills over time. Secondly, it prevents the risk of disconnection, which can disrupt business operations. Lastly, it provides flexibility, allowing businesses to focus on their operations without the pressure of large, upfront payments.

You may also read: MEPCO Bill Paid Status Check Online 2024

Important Points to Remember

When applying for the installment plan, it’s essential to remember that MEPCO has strict rules. Businesses should not assume that approval is guaranteed, and they must ensure all documents are complete when submitting their application. Additionally, staying on top of installment payments is crucial to avoid any penalties or disconnection.

Conclusion

The MEPCO installment plan is a helpful option for commercial consumers who face high electricity bills. By breaking the payments into smaller parts, businesses can better manage their expenses and avoid disconnection. If your business is struggling with a large MEPCO bill, consider applying for the installment plan to ease the financial burden.